Table of Contents

Introduction

Do you want to know how to cancel your Paytm Postpaid account? We’ll assist you. Paytm Postpaid is a fantastic feature that offers the “Buy Now Pay Later” service, allowing customers to transact and make payments using a Paytm credit limit. Users can use postpaid loans for all of their monthly expenses, and on the first of the following month, they will receive a single, combined statement that includes a small convenience fee (between 0% and 3%, if applicable).

However, there may be occasions when you decide to cancel your Paytm Postpaid account because you no longer wish to use the services.

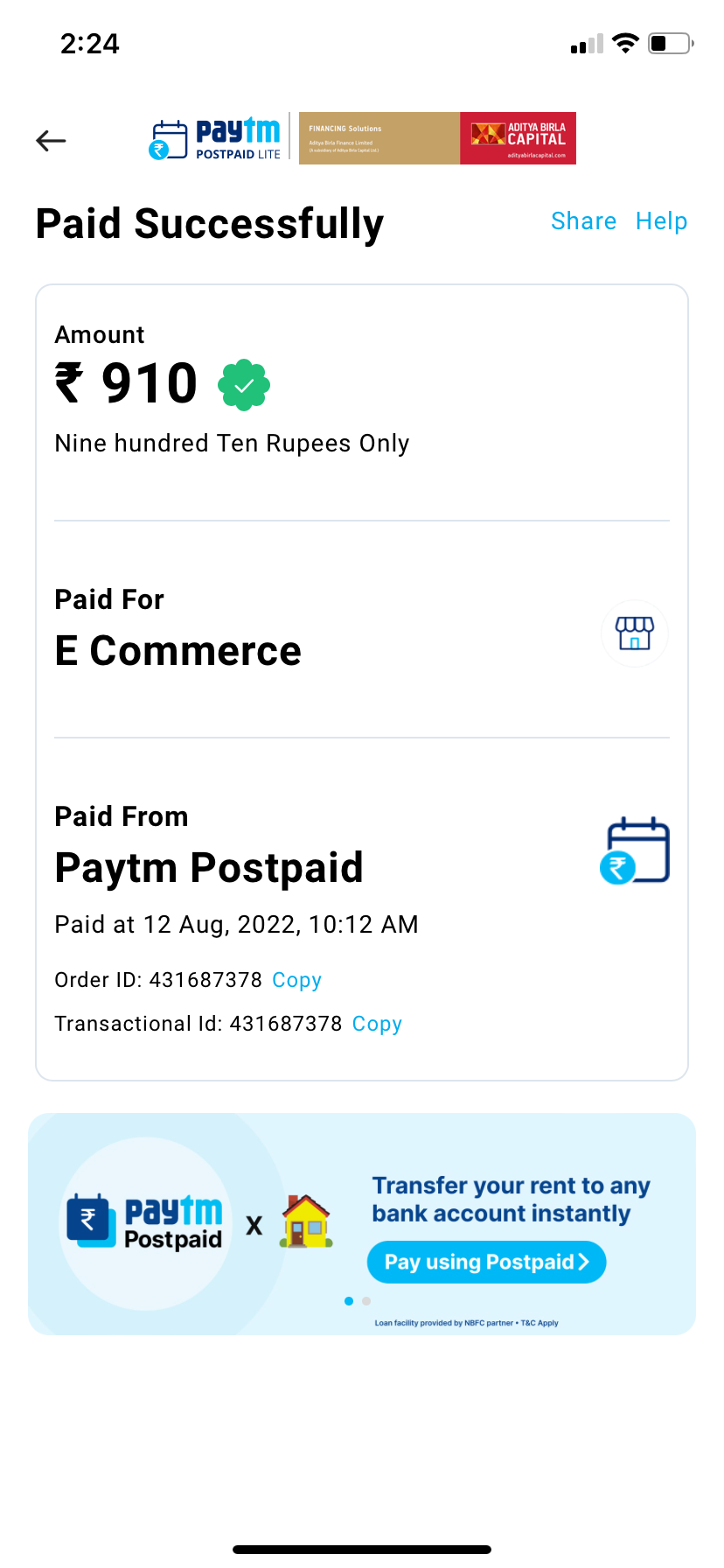

Paytm Postpaid

Aditya Birla Finance Limited and Fullerton India Credit Company Limited, two of Paytm’s NBFC partners, offer a Buy Now, Pay Later option, a postpaid loan. This facility can be used to make both online and offline purchases on over one million websites and retailers, and it comes in the form of a line of credit—small, on-demand loans.

Users are eligible for an instant credit of up to Rs. 60,000 with no interest for up to 30 days. They can buy products with this credit, pay bills, refuel, and reserve tickets.

You have until the seventh of the following month to repay your postpaid monthly expenses.

All you need to do is finish the two-minute onboarding process on the Paytm app to activate the Postpaid loan.

Such a service is offered by various other e-commerce platforms for shopping with different credit limits.

Eligibility

How to Close: Steps?

Paytm always works to offer its customers fantastic options, such as Paytm Postpaid, which lets customers make purchases now and pay for them later. One has to follow certain steps in order to close the Paytm postpaid account. However, we will provide you with detailed information on how to close your Paytm postpaid account if you wish to deactivate it.

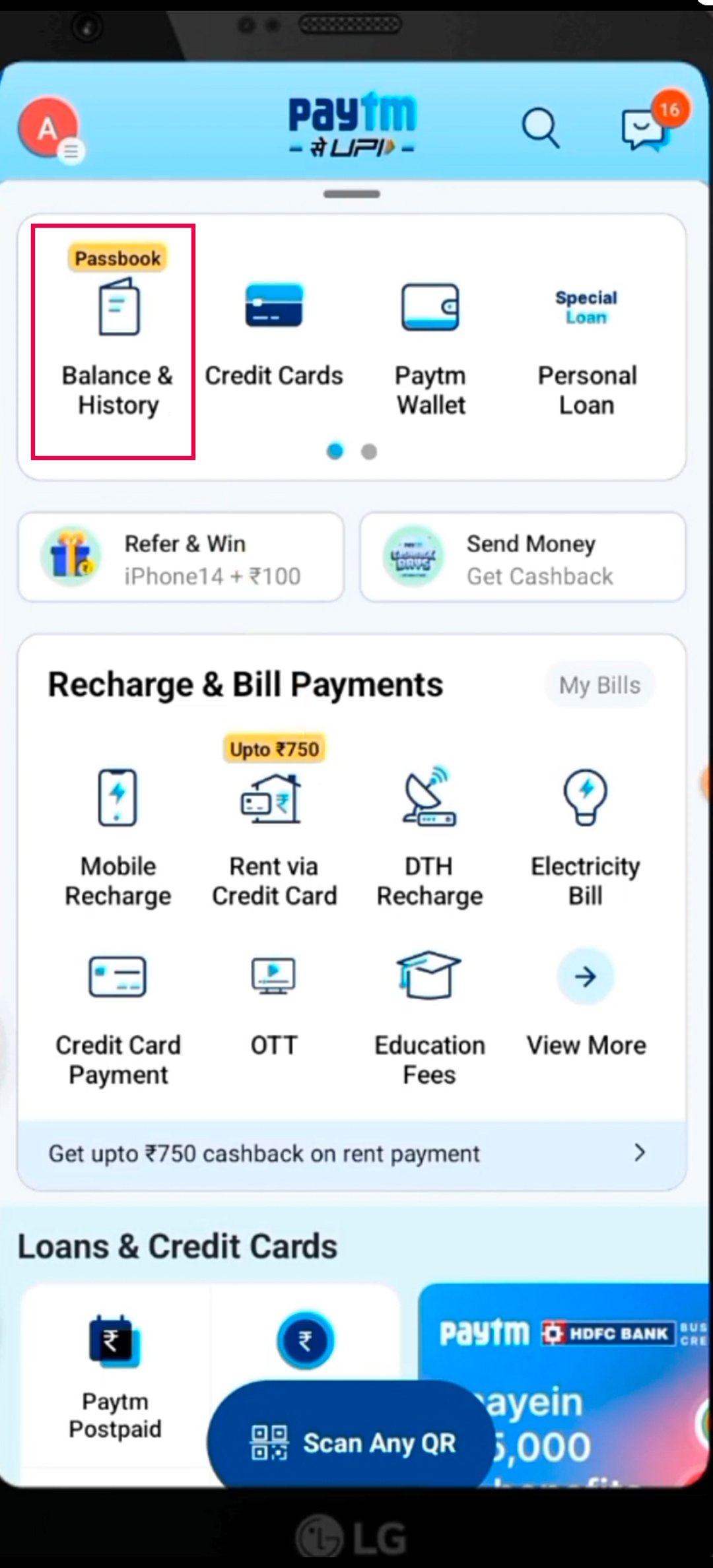

Open the Paytm app first, then sign in using your current phone number.

Select the “Balance and History” option now.

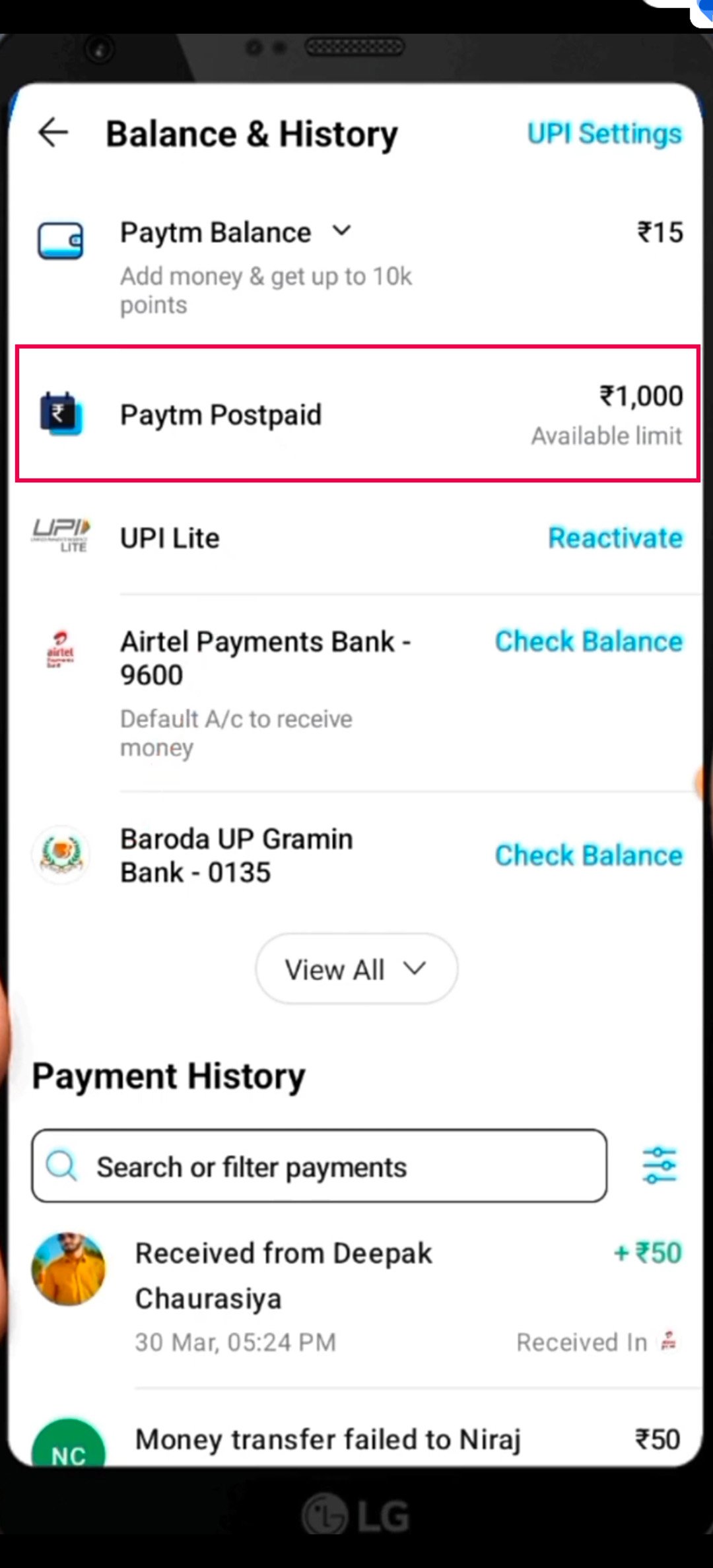

Following that, you’ll see the “Paytm Postpaid” option; tap on it.

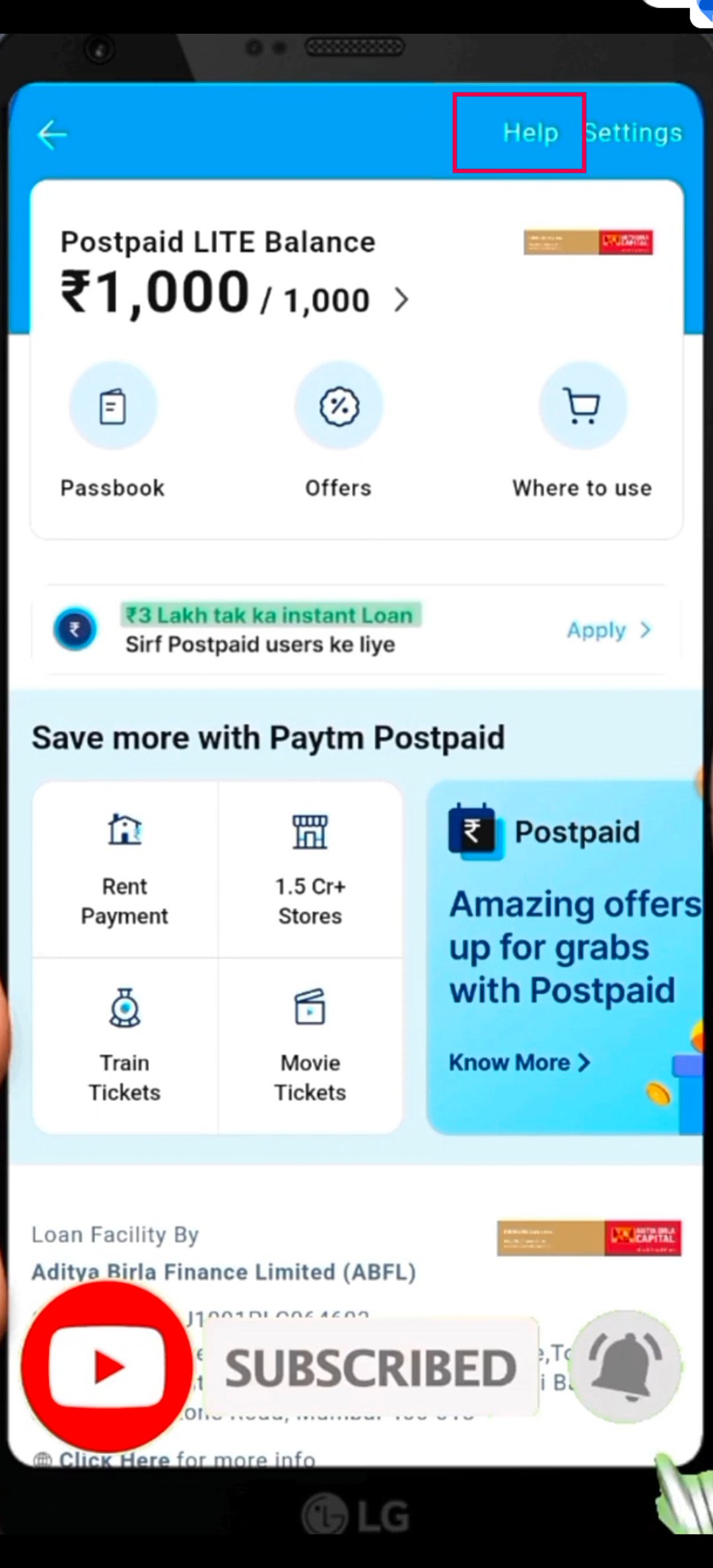

Click the “Help” option that appears now.

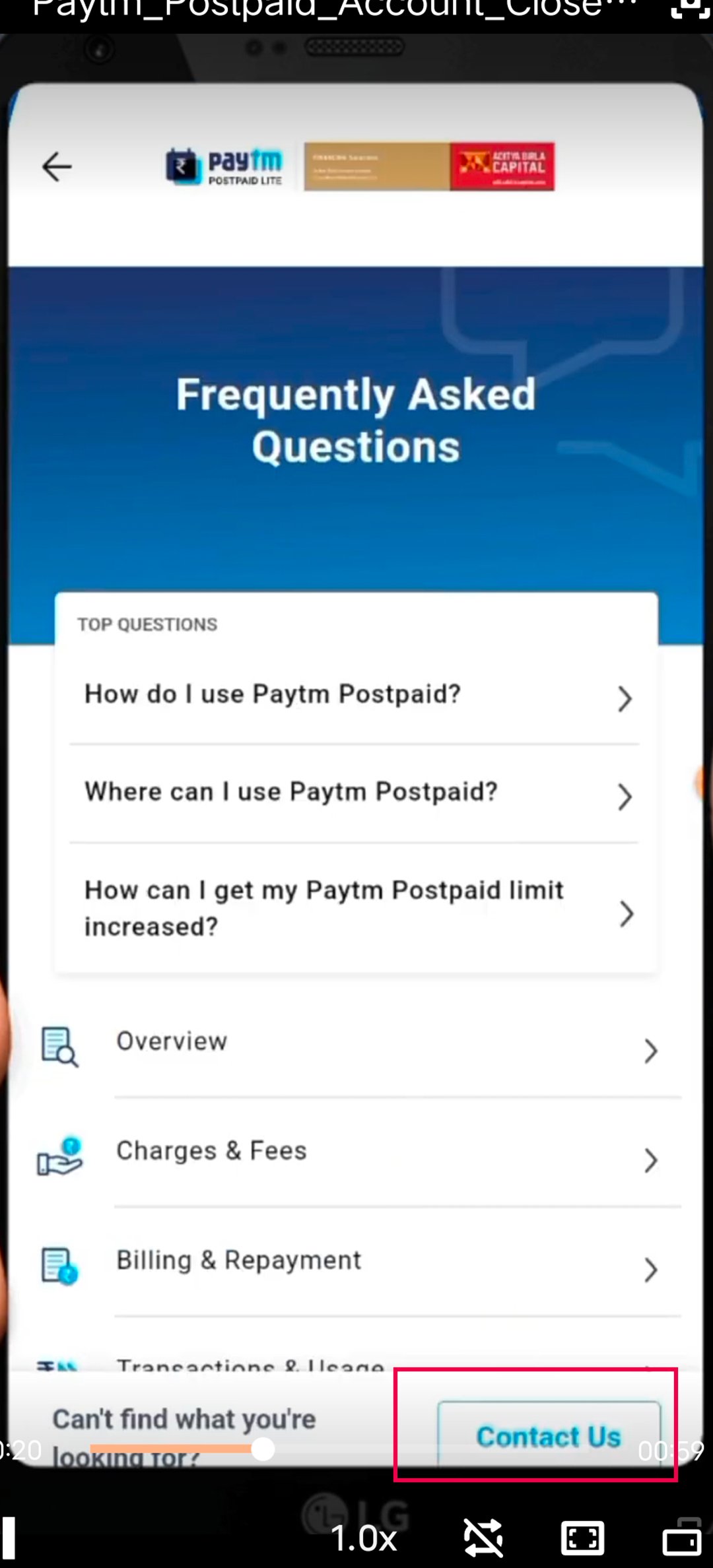

You will then be taken to the following page; select it by clicking the “Contact Us” link

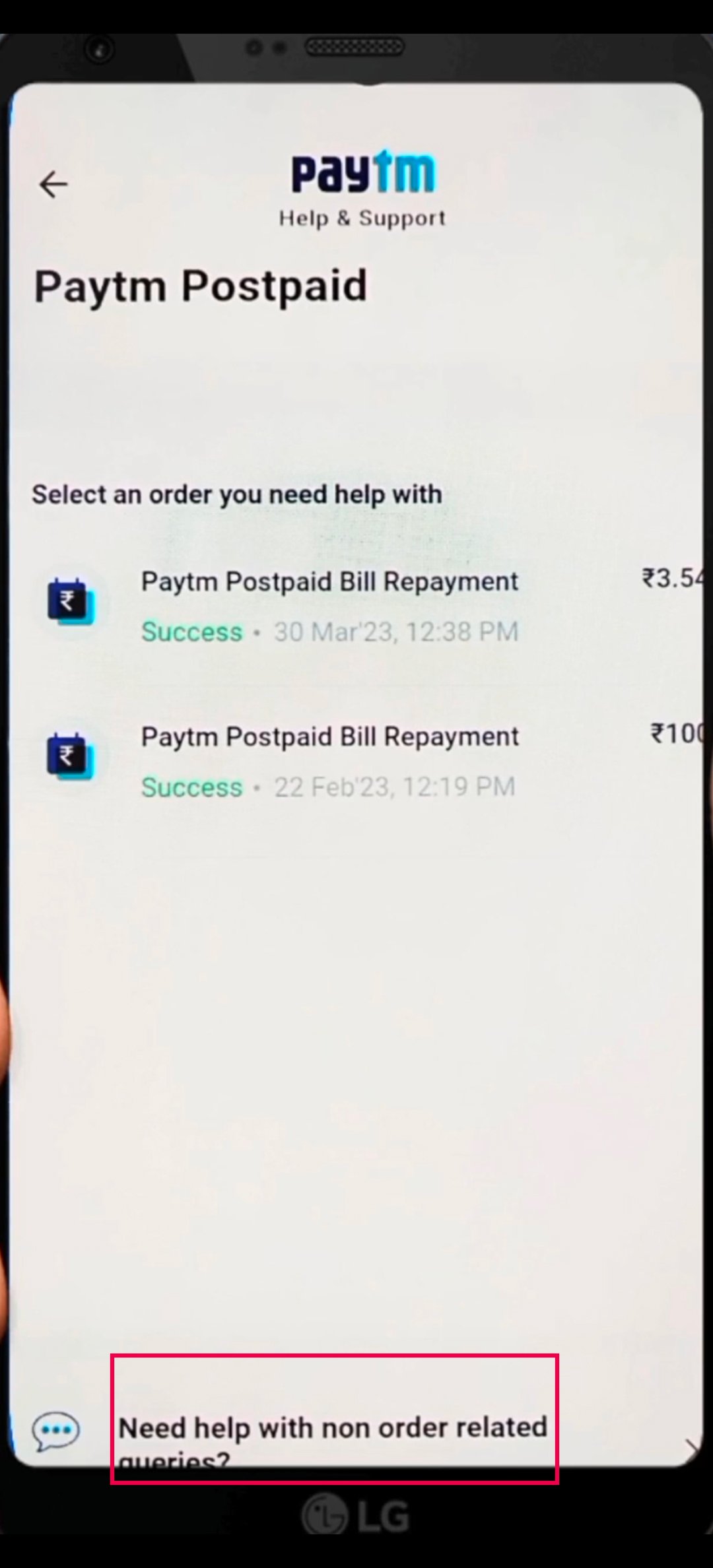

Click the “Need help with non-order related queries” option when you get to the next page.

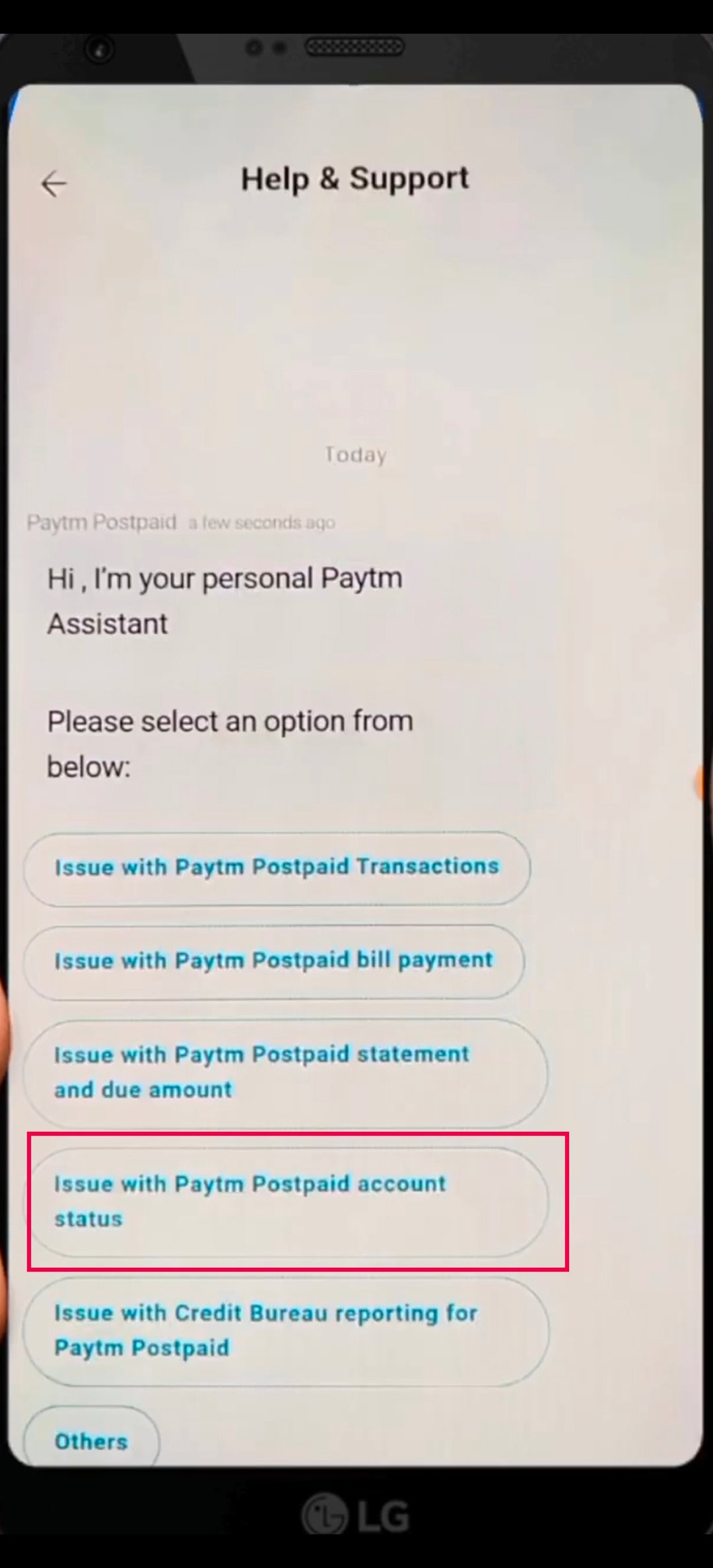

Following that, you will be taken to the “Help and Support page,” where you must choose the “Issue with Paytm postpaid account status” option.

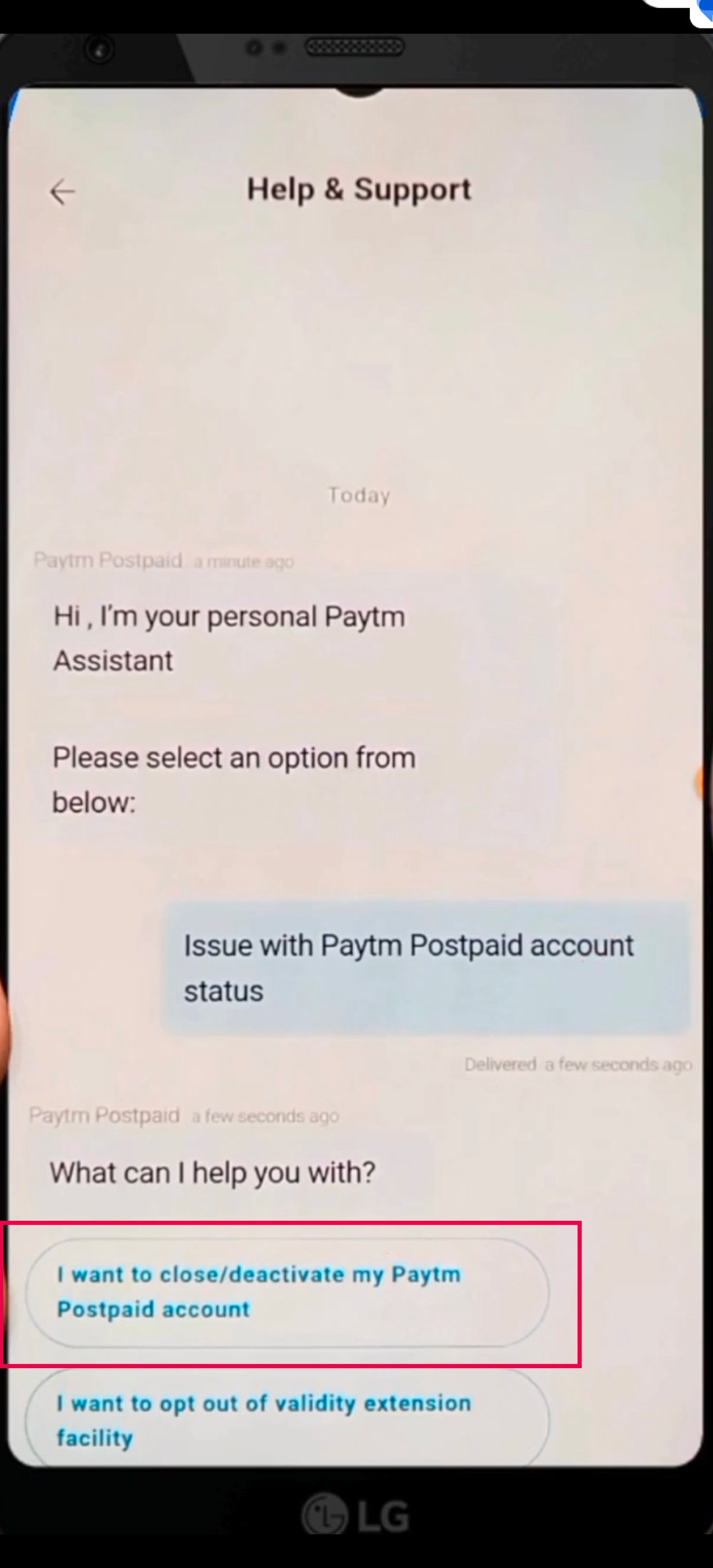

You will now see two additional alternatives. Select “I want to close/deactivate my Paytm postpaid account” from the list of possibilities.

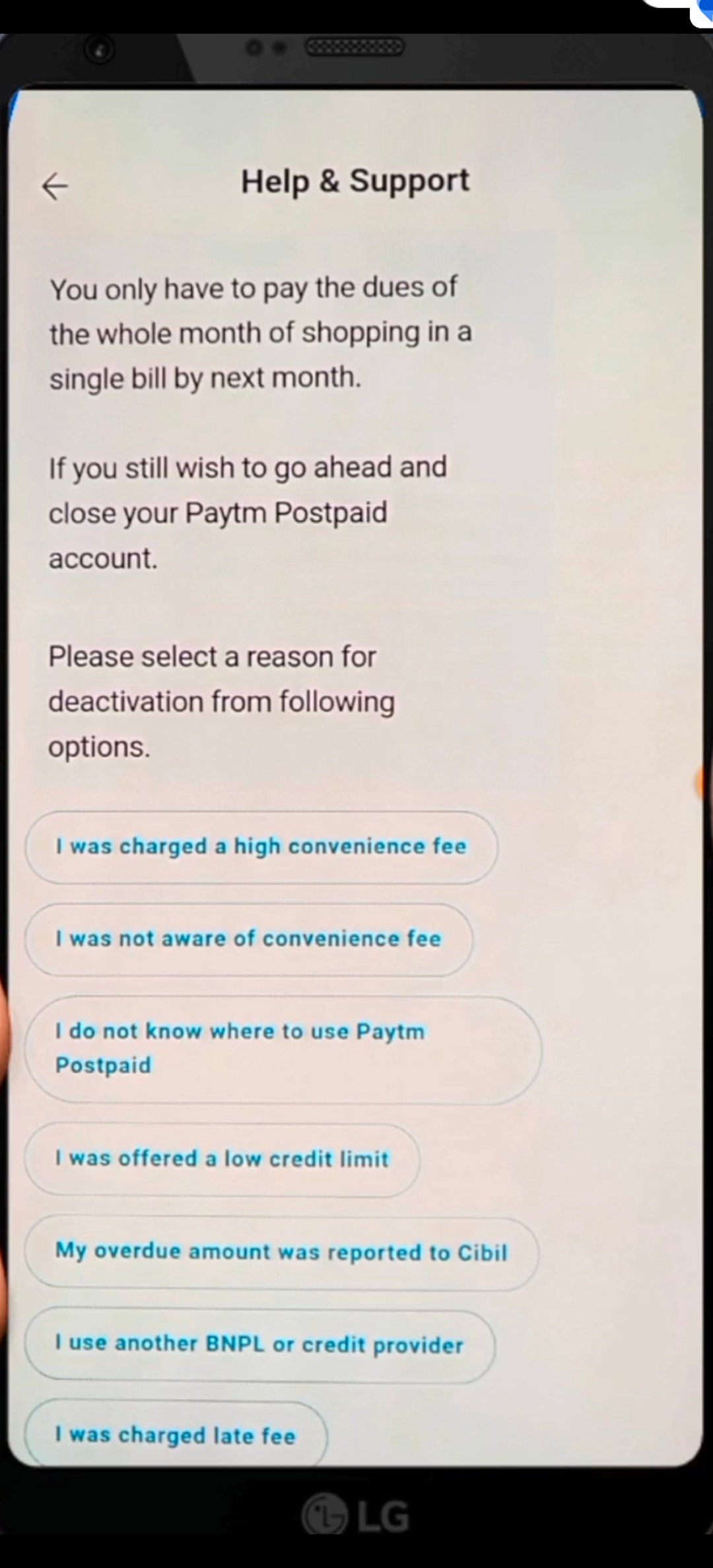

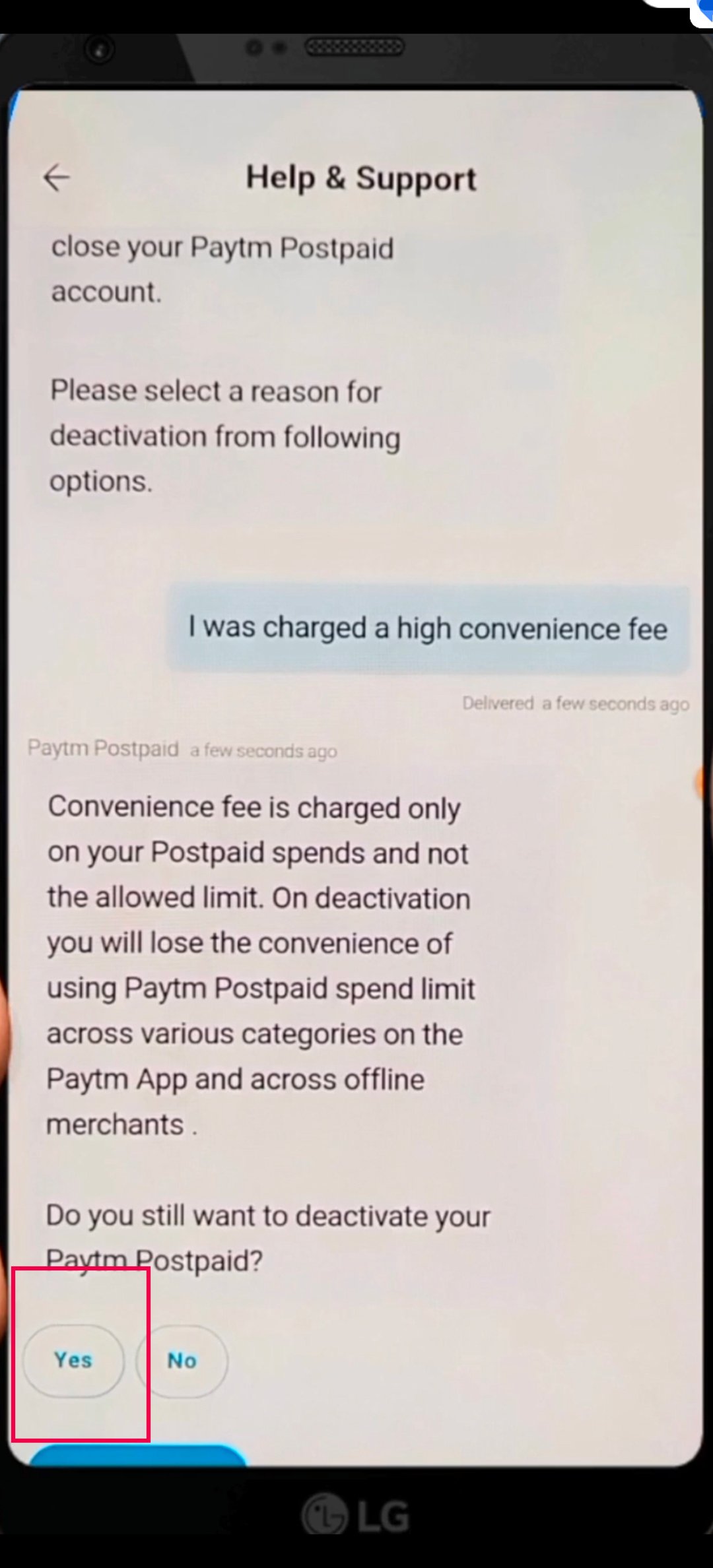

To deactivate your Paytm Postpaid account, choose your desired reason from a lengthy selection.

Upon completion, a confirmation notice on the deactivation of your account will appear; select “Yes.”

Conclusion

Frequently Asked Questions (FAQs)

It takes 90 days from the date of your mobile number’s activation to finish your existing subscription before switching from postpaid to prepaid.

Indeed, you may quickly terminate your Paytm Postpaid account if you decide you no longer want to utilize it.

Yes, Paytm Postpaid impacts your credit score just like a credit card does. Therefore, paying up your Paytm postpaid bill on time can help you establish a positive credit history and open up opportunities for credit card offers and loans.

Yes, With Paytm postpaid, you can receive a credit of up to Rs. 1,00,000.

Yes, Amazon Flipkart and other platforms also offer postpaid or pay later services.